50 percent of MENA VCs surveyed to increase investments in blockchain and crypto projects in 2023

In a

recent survey entitled “MENA Investor Survey 2022-2023 for crypto Blockchain

sector” carried out by laraontheblock with 83 MENA venture capitalists, fund

managers, and family offices, 50% of

those surveyed stated they will be allocating more funds to blockchain and

crypto projects and entities in 2023. 19% of those surveyed stated in 2022 they

had invested more than 50% of allocated capital and funds into crypto and

Blockchain projects.

The

findings of the “MENA Investor Survey 2022-2023 for crypto Blockchain sector” sheds

light on the different areas of interest for MENA investors which will give

startups and entities a better view on whom and where capital will be heading

by investors in the MENA region.

This

comes as cryptocurrency adoption has skyrocketed in the Middle East and North

Africa (MENA) region. According to a survey by blockchain analytics platform

Chainalysis, MENA countries have the fastest-growing cryptocurrency industry in

the world, accounting for 9.2% of global digital currency transactions from

July 2021 to June 2022.

Vast Majority of MENA VCs invested in crypto

and Blockchain in 2022

75% of

survey respondents confirmed that they invested in crypto and blockchain

entities in 2022, while only 25% stated they hadn’t. The MENA region has become

the center for crypto trading, investing and regulation. The UAE led crypto

regulation in 2022 and was the first country in the region to launch a

blockchain strategy back in 2017.

The

stance taken by MENA investors in the survey is in line with global figures. In

2022, despite the slowdown in crypto VC funding, it exceeded the figure for

2021. Cointelegraph Research’s VC Database showed that a total of $36.1 billion

was raised in 2022. This is in contrast to the $30.3 billion worth of funding

in 2021.

Crypto

projects globally attracted $19.9 billion in venture capital (VC) investments

in the first nine months of 2022, 41% higher than a year ago, according to

Pitchbook data.

Crypto and Blockchain entities are the Future

54% of respondents replied that they invested in crypto and Blockchain entities because it is the future, while 42% stated it was because these technologies solve real business problems. Only 18% believed that it was because while risky the return on investment was high. ( note that more than one response for some respondents

The MENA

region witnessed sizable investments in crypto and Blockchain entities in 2022.

For example crypto exchange RAIN received $110 million in investments and

included investors from MENA such as MEVP. BitOasis also raised $30 million

with UAE based Wamda Capital and others.

Significant

developments in the UAE such as the launch of Dubai’s Virtual Assets Regulatory

Authority (VARA), and the announcement of the Dubai metaverse strategy, which

aims to attract more than 1,000 blockchain and metaverse companies as well as

support more than 40,000 virtual jobs by 2030 has also played a role in

enticing investors towards blockchain, crypto and metaverse as did the launch

of Crypto Oasis ecosystem and the DMCC crypto center bringing in 1400 crypto

and Blockchain entities to the

19% of surveyed spent over 50% of their

capital on Blockchain and crypto entities

Interestingly

when asked what percentage of capital or funds available in 2022 was invested

in crypto and blockchain, a whopping 19 percent stated that they had invested

more than 50 percent of funds into crypto and Blockchain entities. While the

majority 33% invested between 5-15% of their capital into crypto and blockchain

entities.

27% invested between 1-5 percent of their capital into crypto and Blockchain, while 21% invested less than 1%.

While the

percentages maybe small compared to other areas, Nickel Digital Asset

Management noted that UAE institutional investors, family offices, and wealth

managers plan to increase their exposure to crypto dramatically by 2023. And

while sovereign funds do not yet see digital assets as investable with just 7%

of global sovereign investors have any exposure to digital assets through

investments in blockchain companies, this is changing.

In May 2022, J.P. Morgan’s global investment strategy outlook elevated digital assets as the preferred alternative asset class alongside hedge funds for 2022. For the first time in history digital assets displaced other alternative strategies. In the report it is noted that digital assets are expected to offer the greatest potential for generating alpha and hedge funds expect as much as 10 percent of their strategy to include crypto.

A PWC

Global Crypto Hedge Fund report in August 2022, found that more than a third of

traditional hedge funds now invest in digital assets, this was double the

figure of 2021

Global

crypto leader at PWC left his role to set up a $75 million digital assets fund

Nine Blocks Capital in Dubai UAE. Henri Arsalanian, founder noted that it was

Dubai’s crypto openness that influenced his decision.

Majority of MENA Investors invested in

Blockchain infrastructure

MENA

investors surveyed were asked where they allocated funds in 2022. 64% of

respondents stated that capital was invested in Blockchain infrastructure

projects. Following Blockchain infrastructure was DeFi. 38% of respondents

stated they allocated funds to DeFi projects. Equally 33-36% invested in

metaverse and crypto assets.

In

addition 22% replied they invested in Non-Fungible tokens or NFT projects,

while 17-18% of respondents stated investments went into e-gaming, tokenization

projects, crypto mining and blockchain crypto payments.

Only 8% stated they invested in decentralized messaging and social media platforms.

The

findings of the survey fall much in line with Cointelegraph’ s recent

blockchain funding VC report which

found that blockchain Infrastructure projects took half the pot of investments

in November 2022. While the Web3 sector saw the most deals closed. The global

blockchain infrastructure sector secured $483.9 million in venture capital in

2022.

According

to Galaxy Ventures,

Crypto and Blockchain sector saw $5.5 billion of venture capital invested in Q3

2022 through 518 deals. Despite the QoQ (quarter on quarter) decrease, the $5.5

billion invested in Q3 is $2 billion greater than the 7-year average of $3.1

billion and more than $2 billion higher than the 2020 peak.

MENA investors will invest more in 2023

51% of those surveyed stated they would allocate more funds to blockchain and crypto entities in 2023. Only 15% replied they would not. In addition 33% were unsure. This means that potentially 84% of those surveyed could be investing more in blockchain and crypto in 2023.

Already

investment companies such as TradeDog Group, the parent company of TD VC, have

launched new funds. TradeDg Group launched their $100 Million Web3 blockchain

special situation fund. The fund will re-structure and invest in projects with

good products and businesses but struggling token markets.

Even UAE

Cypher Capital VC announced in December 2022 the launch of a new $200 million

fund which will focus on infrastructure and middleware investments in Web3. At

the time they had invested in Rekt Studios and Fenix Games, while UAE Shorooq

Partners also announced in March 2022 that they would be investing $150 million

in Web3 startups. Many other investors across the MENA region have been

following suite including Mubadala and G42 both based out of UAE.

Global

players such as Goldman Sachs plans to spend tens of millions of dollars to buy

or invest in crypto companies after the collapse of the FTX exchange hit

valuations and dampened investor interest. Goldman has invested in 11 digital

asset companies that provide services such as compliance, cryptocurrency data

and blockchain management.

MENA investors view Blockchain infrastructure

as biggest growth sector in 2023

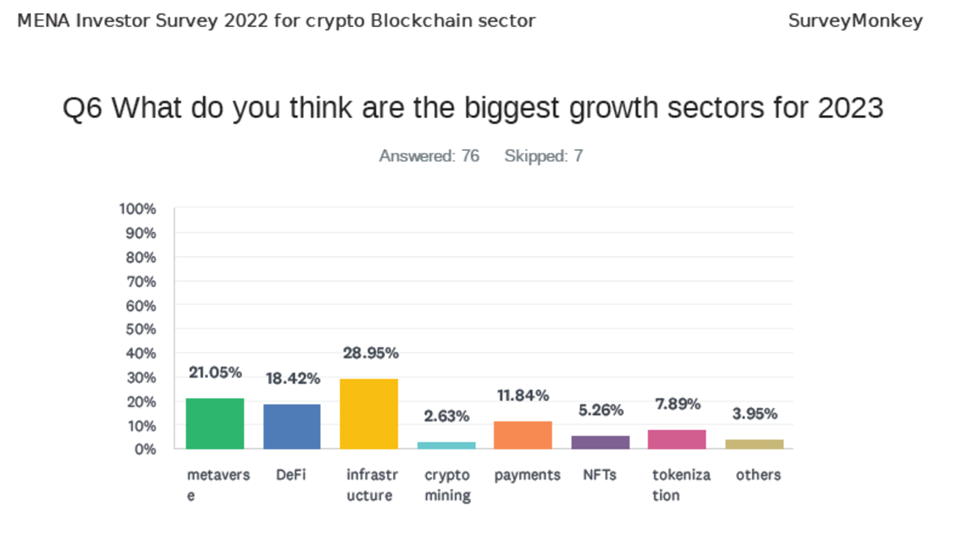

According

to 29% of survey respondents, Blockchain infrastructure projects will witness

the biggest growth in 2023. Data gathered by BuyShares.co.nz, found that the

global spending on blockchain solutions is expected to surge by 235% and reach

$14.4bn by 2023.

Following, 21% view metaverse projects as high growth sector technology. This is in line with findings from Grand View Research, which states the global metaverse market is forecast to grow at a compound annual growth rate (CAGR) of 39.4% from 2022 to 2030.

Meanwhile

18% of those surveyed think DeFi will

witness strong growth. DeFi has been the largest market cap activity within

Web3, with a peak total value locked (TVL) of over $175 billion in 2021

shrinking to $39 billion in 2022. Yet Digital asset research firm Reflexivity

Research in its recently published 2022

Annual Year in Review / Forward Outlook 2023 believes that given the blow to

trust in CEXs, investors will be drawn to decentralized alternatives. The

report believes DeFi TVL could make its way back to $75 billion or $100

billion.

12% of

those surveyed view blockchain and crypto payments as one of the growth sectors

for 2023. Cross-border payments and settlements are considered the most

prominent blockchain use case. According to the IDC Worldwide Blockchain

Spending Guide, Blockchain enabled cross border payments accounted for 15.9% of

the $4.67-billion blockchain market in 2021. Juniper Research estimates that

B2B cross-border payments on blockchain will account for 11% of the total B2B

international payments by 2024.

When it

comes to investment in tokenization projects 8% of those surveyed believe that

tokenization sector will be a growth sector in 2023. 5% of those surveyed

believe NFT sector will grow in 2023, only 3% of those surveyed believe crypto

mining will be a growth sector.

Conclusion

In

conclusion from the responses of 83 VCs, investment funds, across the MENA

region that included names such as Oman Investment Authority, Equinox,

Synaptech Capital, CypherCapital, Helion Ventures, Carter Capital, AlIImtiaz

Investment Group, True Global Ventures, Roshan Investments, Crypto Oasis, Ghaf

Capital Investments, Vault Investments, and many more, the reflection is a

positive outlook when it comes to crypto and Blockchain and a growing interest

in investing in projects. So while 2022 might have been one of the toughest

years on crypto and Blockchain, it has not killed the appetite of investors in

MENA!

Readers can also read this article in arabic on Cointelegraph MENA

Comments

Post a Comment