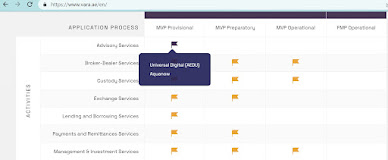

UAE based Aquanow, digital assets infrastructure provider receives initial approval from Dubai's VARA

Aquanow, a digital assets infrastructure provider has unilaterally announced that it has received initial approval from Dubai’s Virtual Asset Regulatory Authority (VARA), while it undertakes the in-depth process of applying for a license in accordance with VARA requirements. Full approval to operate will be issued by VARA as soon as Aquanow completes all mandated requirements, which the firm is expected to complete in the near-term. “At Aquanow, we believe that the UAE is a forward-thinking jurisdiction for digital assets regulation and we view Dubai as a key hub for our international growth efforts,” said Aquanow’s Chief Executive Officer, Phil Sham. “We’re excited to receive the initial approval from VARA and to be moving closer to powering a range of digital asset use cases in the region.” Aquanow, which is privately-backed, is one of the largest digital asset liquidity providers and is a global leader serving financial services clients in 40 countries around the world. ...