India’s CoinDCX investment into UAE BitOasis crypto broker breaths new life into the company

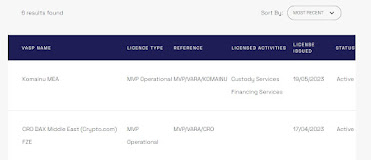

UAE based BitOasis crypto broker exchange has announced that it has secured an investment from CoinDCX, India’s biggest crypt exchange. This comes after BitOasis’s license was suspended by VARA for not meeting requirements. The latest investment will give BitOasis a new life line. As per the news, the new capital injection will help to support BitOasis’s vision to amplify its regional presence and secure further licenses in the region. Commenting on the news, Ola Doudin, Co-Founder and CEO of BitOasis said: “We are delighted to be working with CoinDCX, India’s leading crypto platform. From our first conversations, it was clear we share a common vision and synergies across our markets that we look forward to building towards. The investment will allow us to sharpen our focus on perfecting our existing products and expanding across our markets. We are very excited about the opportunities the funding will unlock for us.” Sumit Gupta, Co-Founder and CEO of CoinDCX stat...