Dubai regulated TOKO tokenization exchange partners with Virtuzone to offer blockchain enabled VC funding

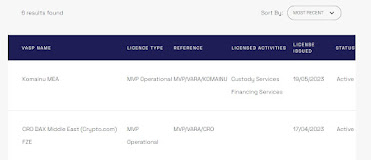

Dubai regulated virtual asset broker and exchange TOKO FZE a creation of international law firm DLA Piper, has partnered with Virtuzone, a pioneer in business solutions and corporate services for the region. The partnership will include the establishment of a tokenized equity crowd funding platform will further cement Dubai’s standing at the forefront of financial innovative and as a destination for early stage and fast growth companies seeking a supportive business environment. TOKO has just received a fully operational license from Dubai’s Virtual Asset Regulatory Authority (VARA). The partnership with Virtuzone is set to transform early-stage private equity fund raising using blockchain technology to bring enhanced transparency, accessibility, and opportunity for both investors and the businesses seeking to raise funds. Across a variety of compelling businesses, investors will have greater insight, information and access to private equities for their portfolio and ...