Japanese Nomura Bank’s digital asset custodian Komainu receives MVP operational license from Dubai regulator

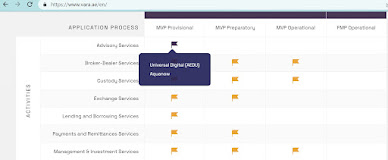

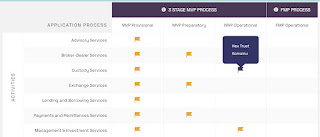

Japanese Nomura Bank’s, Komainu, a regulated digital asset custody provider, has received an MVP (Minimum Viable Product) operational license from Dubai’s Virtual Asset Regulatory Authority (VARA). This is one step from receiving the full operational license. This also follows HexTrust another digital asset custodian who received the license prior. Under the license Komainu will be able to offer both custodial and staking services. Komainu had received provisional regulatory approval from VARA in July 2022 allowing it to commence operational readiness even as the application goes through the warranted due diligence. Komainu acts as key gatekeeper to institutions gaining exposure to the digital asset industry with the provision of secure and regulated digital asset custody services for blockchain and beyond. Over the years, Komainu has established itself as one of the leading digital asset custody providers for institutional clients, providing the same safeguards and protection