Dubai's virtual asset regulatory authority opens the door to regulated crypto staking services

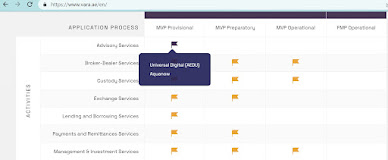

Dubai’s virtual asset regulatory authority VARA opens the door to regulated crypto staking services with its revised Custody Services Rulebook, allowing staking by virtual asset custody Service providers. As per the revised rule book , virtual asset service providers who carry out custody services can offer staking services as well withouth obtaining a separate licence for VA Management and Investment Services. Additional licensing and supervision fees will be payable in connection with the provision of this additional service. As per the amendments, VASPs Licensed by VARA to carry out Custody Services may only provide Staking from Custody Services, if explicitly authorised to do so by VARA, and such authorisation is expressly stipulated in their Licence. There will be incremental fees for custody services. VASPs who are authorized to offer staking services, will have to comply to all the rules related to custody services while they are offering their staking...

.jpg)