UAE regulated virtual asset investment manager, Laser Digital launches Bitcoin Adoption Fund

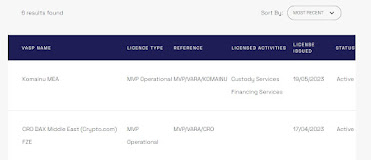

UAE regulated virtual asset broker dealer and investment management services, Laser Digital, a subsidiary of Nomura has launched their Bitcoin Adoption Fund. The fund, which provides a seamless way for institutional investors to access the digital asset class, will be the first in a range of digital adoption investment solutions that Laser Digital Asset Management will bring to the market. The Laser Digital Bitcoin Adoption Fund, provides long-onlyexposure to Bitcoin whilst being one of the most cost effective and secure investment solutions. To secure the fund's assets, Laser will use Komainu, which was founded in 2018 by Nomura, Ledger and Coinshares and delivers a regulated custody solution for institutional digital asset investors. The Fund is a segregated portfolio part of Laser Digital Funds SPC, aSegregated Portfolio Company registered asa mutual fund pursuant to section 4(3) of the Mutual Funds Actwith CIMA (Cayman Islands Regulatory Authority). On launching the ...