Crypto trading in Qatar flourishes despite Central Bank ban

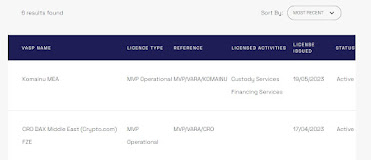

Over the past years and despite the continuous banning of crypto in Qatar by the Qatar Central Bank, crypto trading and investing in Qatar is flourishing reflected in various ways. The first reflection of the attractiveness of crypto trading in Qatar is the statement made by Qatar’s Ahli bank, at the end of May 2023. The bank warned customers against, trading, buying and selling virtual assets and currencies through accounts and banking services, citing the reasons as being associated with high risks. Secondly Triple A report in January 2023 put Qatar’s crypto ownership at 0.9 percent of the population, around 24,000 people. Since then it could be the numbers have increased. Just over a year ago CoinMENA had announced that it was serving clients in Qatar. Even Bahrain’s RAIN crypto broker supports Qatar, as does UAE based BitOasis. But the third and most significant reflection of the growth of crypto in Qatar is the recent MENA FATF report , where they mention that Qatar